|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

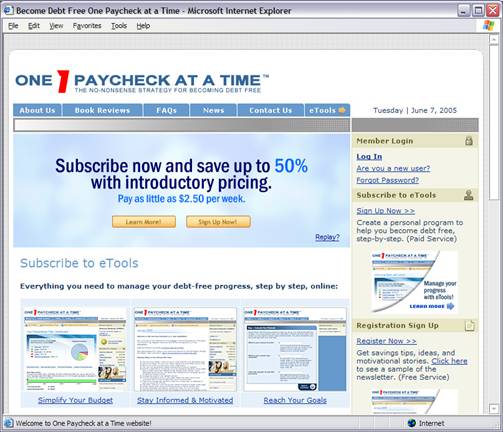

One paycheck at a time One Paycheck at a Time Inc., providing easy, no-nonsense debt-elimination strategies, received the prestigious award of Best Financial Services Interactive Application in the 2005 Internet Advertising Competition (IAC) Awards sponsored by the Web Marketing Association. The website was voted the best in its industry category for the interactive medium. The One Paycheck at a Time website incorporates eTools to provide subscribers with an online, interactive guide to targeting and paying off debt on a paycheck by paycheck basis. This strategy differs from most other debt reducing programs in the marketplace that tend to focus on the traditional monthly bill payment process. The website eTools enable users to easily follow the process and see their progress through a customized graphic interface. Once the customer has worked the program to pull themselves out of debt, they may choose to further develop their money management skills by utilizing the savings module also included in the eTools application.

The Challenge

She had some very specific ideas in mind about how the online application should work. In addition to meeting the objective of creating interactive tools to make it easy to setup and manage a personalized budget she wanted customers to have the flexibility to: · Create a spending plan specific to their income and expenses while automating all the calculations, · Develop a program for a one- or two-income household, regardless of the timing of the pay periods, · Ensure complete privacy and security of each customer’s information with 128-bit encryption technology, · Manage spending choices in just a few clicks, · Access and print out personal reports anytime of day or night to follow each pay period, and · Develop a sensible savings plan once the customer is out of immediate danger of debt. The best way for Clearcubed Interactive’s designer, Mo Usman, and programmer, Jeff Johns, to understand the task at hand was to read the book. Translating the concepts from the book into an online budgeting application would prove to be challenging. “Everyone’s financial situation is unique. It would be impossible to create a one-size-fits-all-solution since no two individuals carry the same credit card debt with the same loan products,” says Jeff Johns, programmer of Clearcubed Interactive. That said, they ventured to create an online application that would prove to have wide appeal. The Solution The One Paycheck at a Time online budgeting program was named eTools. The eTools may be used independently of the book, although using them together will certainly accelerate the mastery of the debt reduction principles. It is clear how the One Paycheck at a Time concept of debt reduction based on pay period bill paying is different from other debt reduction programs. The eTools online is different from other money management applications because:

Most money management software applications lead you through a monthly budget as this typically is the timetable on which our expenses are based. The general public has been well trained to pay bills monthly even though most people are paid on a different schedule. More times than not this approach to budgeting creates a cash-flow deficit. The One Paycheck at Time eTools subscription is a month-to-month service allowing customers to access and personalize their debt reduction plan and utilize tools to shrink their debt. The subscription automatically renews each month unless the customer chooses to cancel the service.

The book and eTools describe and calculate a method to managing

money, One Paycheck at a Time. This is a fundamental premise is

based on the tried-and-true envelope system. The foundation of the

envelope system is to dedicate one envelope per expense and set

aside money in each envelope until that particular bill is paid. The

envelope system becomes a filing system for managing your money. The User Experience The One Paycheck at a Time eTools help customers design and implement a plan to become debt free in the privacy, comfort, and convenience of their own home or office through a web-based application. Customers may access their information from any computer in the world as long as it is connected to the Internet. The program not only provides a program to become debt free, but helps to identify where an individual may be overspending in the process, and beyond. Once the customer inputs their income and expenses, a series of calculations are performed for each of their paychecks. The program then provides a plan detailing cash available for spending for the week, bills to be paid, and suggests ways to accelerate the process of getting out of debt. No matter how much or how little money a customer earns, the program is tailored to their unique financial situation.

With introductory pricing, a new customer has a choice of signing up for a monthly or quarterly service. · The monthly charge is $12.50 for the first month, and $16.95 for each subsequent month. · The three-month subscription includes a one-time payment of $30; with this option, customers also receive the One Paycheck at a Time eBook (retail value $9.95) free. This subscription package offers the best value as it provides the customer with a 50 percent savings on the entire purchase. Private Labeling Opportunity One Paycheck at a Time, Inc. and Clearcubed Interactive, Inc. are partnering with financial institutions, associations, and debt relief organizations interested in private labeling www.OnePaycheckataTime.com for their customers. “Companies choosing to license the One Paycheck at a Time application will have a great deal of flexibility with the program, including the ability to brand, customize the user experience, and integrate with legacy systems,. Private labeling of the program may be especially beneficial for lending companies experiencing a high level of loan defaults. Etools can give lenders a value-add service to offer their customers, while decreasing defaults and non-payment of extended credit,” said Ms. Griffiths. For companies looking to add an online budgeting application to their product line, Ms. Griffiths may be contacted to discuss via email at kgriffiths@onepaycheckatatime.com.

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||